Taken from WWD.com

Published: Tuesday, February 19, 2008

Mention the Philippines and images of coconut trees, white sandy beaches and Imelda Marcos and her 3,000 pairs of shoes come to mind. But gleaming malls showcasing Louis Vuitton, Bulgari, Prada and Gucci — in a country of 88 million and a per capita income of $1,352?

In fact, retail — including the luxury and high-end variety — is alive and well in the Philippines, with its booming economy. In 2007, the gross domestic product grew by a healthy 7.3 percent.

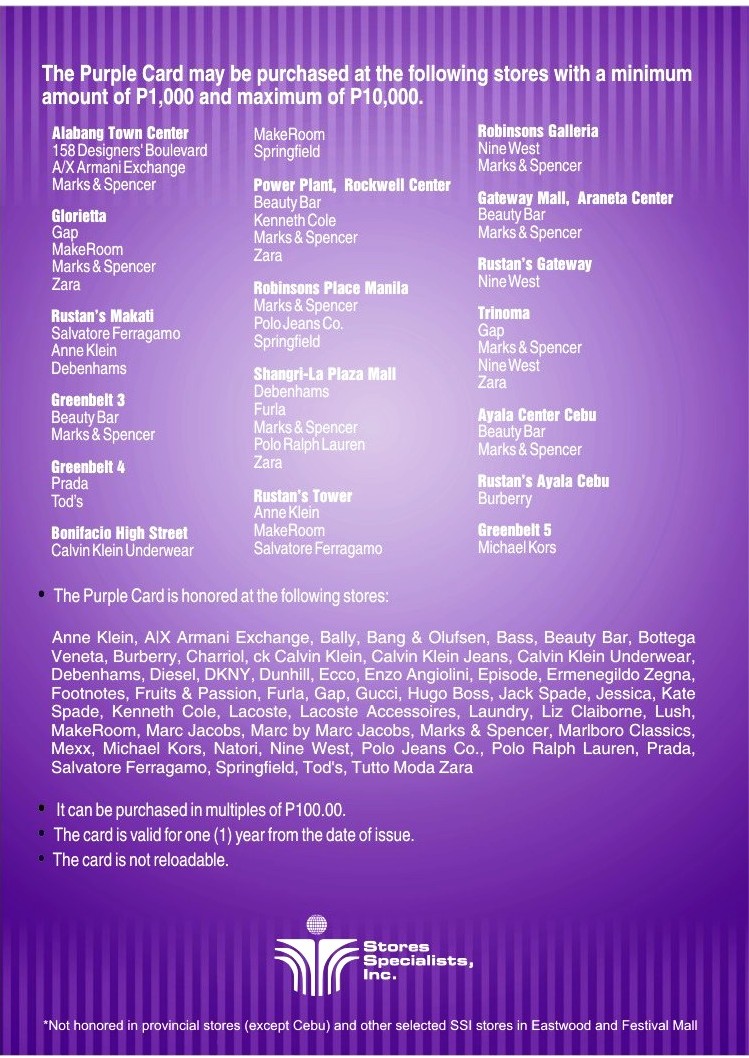

“The Philippines has a thriving retail scene brought about by our well-developed mall culture,” explained Anton Huang, executive vice president of Store Specialists Inc., the store operator in the country for such brands as diverse as Zara, Marks & Spencer, Marc Jacobs, Kate Spade, Cartier, Lacoste, Polo Ralph Lauren and Tod’s, among others. Huang is well positioned to make such a statement: With a platform of 56 brands trading in 260 freestanding stores and in-store shops all over the country, SSI is a key tenant, if not an anchor tenant, in the upscale malls.

Malls, many of them groundbreaking and directional in design, have been sprouting up all over the country’s urban areas in the last 10 to 15 years. The biggest mall developers tend to be subsidiaries of top conglomerates, most of which are family-owned. While the Sy Family of SM Holdings, who built Megamall and the massive Mall of Asia, and the Gokongwei family of Robinsons have catered mainly to the mass and middle tiers of the market, Ayala Land, the property arm of the Zobel-controlled Ayala Corp., has concentrated on developing the premium market with developments such as Glorietta and the much-awarded Greenbelt complex, located in the central business district of Makati City, which is adjacent to Manila and part of the capital district. The patriarchs of the Zobel and Sy families are on the Forbes Billionaires List.

As Rhea de Vera-Aguirre, brand manager for Louis Vuitton in the Philippines, said, “While the Philippines has some of the biggest malls in the world, we have very few that cater specifically to the luxury market and provide the right environment for a luxury brand.”

Louis Vuitton has been in the country since 1993, first at the exclusive Ayala-owned 6750 Ayala Avenue street-level development Makati City. Vuitton occupied one corner and Bulgari the other. In 2004, both brands moved to Greenbelt 4. Bulgari has kept its salon in 6750 open for, according to country manager Mario Katigbak, “customers who prefer to keep a low profile.”

De Vera-Aguirre noted that “the move to Greenbelt 4 was driven by the growth of the business, the addition of other categories and the resulting need for more space. We actively supported the Greenbelt 4 project since the beginning, and that gave us the opportunity to select a premium location — a requirement that the brand has for any store that we open. Greenbelt 4 also provided an environment consistent with our brand image and values, and ultimately became the number-one luxury shopping destination in the country. Our sales have grown significantly since our move.”

Rowena Tomeldan, malls manager for Ayala Land, recounted how, originally, the Greenbelt 4 extension was earmarked for dining and speciality outlets. The spacious and chic Greenbelt 3 was already home to Kate Spade and Jack Spade, alongside the French high-street label Celio, the multibrand store Mix and Firma, the sophisticated jewelry and accessories boutique, “but the principals of the foreign brands approached us and asked us to develop a space for them. This was an opportunity, of course, and we took advantage of it,” Tomeldan said.

Indeed, Greenbelt 4 glitters with the storefronts of luxury labels including Gucci, Prada, Vuitton, Tod’s, Ferragamo and Bulgari.

“We’re very heavy into market research,” added Tomeldan. “We believe in listening to the customer, which then helps us to identify gaps in the market. Each of our malls has a unique personality. We don’t build cookie-cutter developments. Greenbelt 4, for instance, was created as the flagship setting for established luxury brands. With Greenbelt 5, we are focusing on fashion’s new guard, as well as the best of Filipino design.”

Greenbelt 5 opened last October, and while some shops are still empty, all the spaces have been leased out. Tenants include Balenciaga, Marc by Marc Jacobs, Paul Smith, Banana Republic, Rafe and Celestina.

There is a palpable energy among retailers and customers regarding the new mall, a fluid and well-designed space surrounded by lush greenery. Rafe Totengco said his store there — the first in his home country — is doing quite well.

“We have been pleasantly surprised by the results and we haven’t even had a chance to do a real opening party,” he said.

The store is a franchise owned by the husband-and-wife team of Ricco and Tina Ocampo. They represent one of the pioneers of multibrand fashion boutiques in the Philippines with their store Mix, which sells Vera Wang Lavender, Cynthia Vincent, Seven For All Mankind, Trina Turk, Vivienne Tam and Milly, among others. The Ocampos have been carrying Rafe for many years.

Mia Borromeo of Mix said “Rafe’s line started out with bags then expanded to shoes, both of which have built a steady following at Mix. So with the opening of Greenbelt 5, we felt it was the right time to provide a wider selection of Rafe’s products to our clients.”

Huang says it is no longer accurate to regard the Philippines as an insignificant player in Asia-Pacific retail. In a WWD List in December ranking projected clothing and footwear retail sales in the region, the Philippines placed ninth with $1.5 billion.

“In the beginning,” Huang recalled, “SSI was very active in approaching the brands and strove hard to sell the Philippines as a potential market opportunity. However, we are no longer as ‘under the radar’ as we used to be a decade ago. Although SSI still relentlessly pursues quality names that our market has grown sophisticated enough for, it is not uncommon for us to be contacted by brands that want to expand in the region.”

Mark Gonzalez, who is opening the Balenciaga store in Greenbelt 5, also carries Lanvin, Azzedine Alaïa, Marni, Jil Sander, Dior Homme, Y-3 and Acne Jeans at his multibrand boutique Homme et Femme at the Shangri-La Plaza Mall in the suburb of Ortigas, 15 minutes from Makati City. He describes the current retail climate as exciting but competitive. “With real estate developments aimed at the luxury market, combined with a favorable exchange rate, there are a number of new retailers, not to mention retailers that are expanding, like us.”

Establishing a foothold in the market was “an uphill battle,” as he focused on directional designers.

“Fundamentally, these lines need a stable retail climate, a more confident and advanced consumer,” he said. “It took a while for us to build our niche, to be understood.”

It is fair to say that a combination of factors have contributed to the buoyant retail scene in the country: a strong economy, a strong currency, the presence of world-class retail developments and the growing sophistication of Filipino consumers. While these consumers make up a small percentage of the population, their purchasing power is still vital and significant.

De Vera-Aguirre claimed that, over the years, the customer mix at Vuitton has evolved. “Our market used to be limited to the more traditional luxury connoisseurs, but now we are seeing a huge growth in the younger and more fashion-forward segment. Generally speaking, the Philippine luxury consumer is very knowledgeable about products and the latest trends, expects the highest level of customer service and tends to be brand-loyal.”

Huang concurred: “The typical Filipino luxury consumer is a well-traveled individual who is familiar with fashion trends worldwide. This consumer is increasingly becoming more sophisticated and discriminating as more choices become available locally.”

As for the size of this market, Huang admitted that “we are a relatively small market. However, just like other developing economies, we have a strong upper market segment and a growing middle class that serves as an aspirational consumer base. These two segments in the market make up our core domestic consumer.”

The sizable expatriate community and foreign tourists also form part of the customer base.

As for the aspirational consumer, Manila-based fashion blogger and former fashion editor Liza Ilarde-Cuenca remarked, “It amazes me that each time I enter the one and only Louis Vuitton shop in the country, the place is always full of people. And these people are actually buying bags — and paying in cash.”

According to De Vera-Aguirre, the best-selling item at the Vuitton store is the Speedy 30, which is priced at 34,200 Philippine pesos, or $855 at current exchange.

Juan Miguel Ongsiako, the young entrepreneur behind the hip Pauwwl Smith and Ben Sherman brands, is also opening a new 1,700-square-foot Paul Smith flagship in Greenbelt 5. He believes that “in retail, it is important that you have a unique product to offer, and that you merchandise it well. That includes investing in a good shop front, because that’s what draws the customers in.”

Initially he got into retail in 2000 with a 750-square-foot Paul Smith boutique in the Ayala-developed Glorietta 4, and he said he was fortunate to be in a position “to develop the market, and not for profit; in fact, it was more of a vanity thing for me. Recently, however, sales have been phenomenal.”

“The key,” Huang said, “to successfully working in this environment is to realize and accept the fact that the sales opportunities are not large but that the market is ever developing and becoming more sophisticated. As for the future, we are always open and, more importantly, always on the lookout for new ideas and market opportunities.”

[email_link]

Recent Comments